2021 estimated tax payment vouchers

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

If you choose to use last years income just divide your total tax liability from your most recent 1040 by four to get your quarterly income tax payment.

. You can go through the section in your return to make adjustments to your expected income for 2021 in order to recalculate the vouchers if you do expect to make the. If you prefer to pay based on this years. The current standard payment vouchers are.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The annual tax payment is due with LLC Tax Voucher FTB 3522. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information.

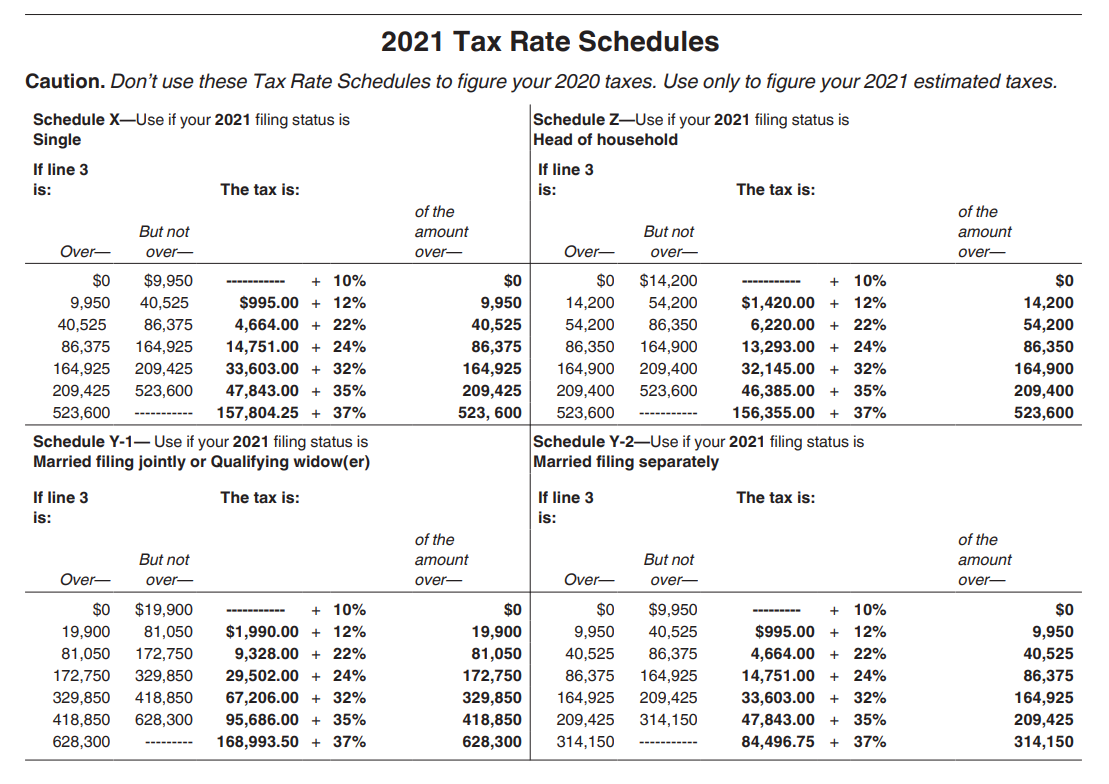

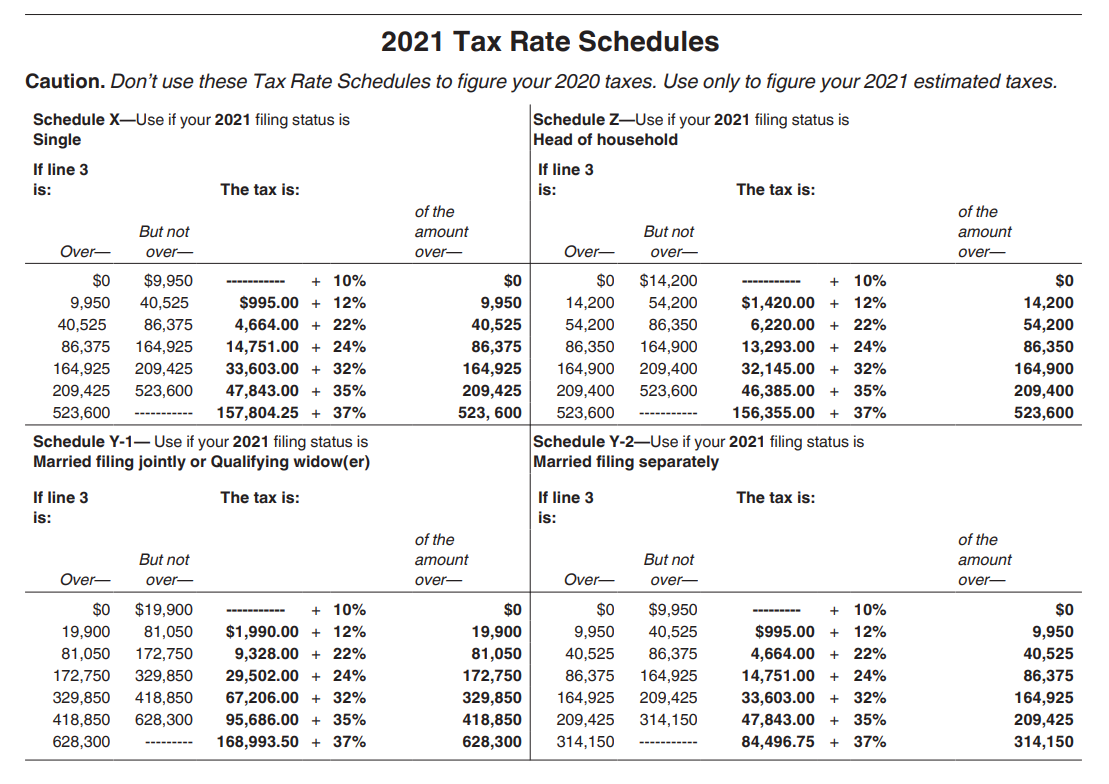

Payments due April 15 June 15 September 15 2021 and January 18 2022. It as a credit to your 2021 estimated income tax the amount of overpayment may be applied in whole or in part to any installment 2021 Massachusetts Department of Reve nue period. Exceptions to the first year annual tax.

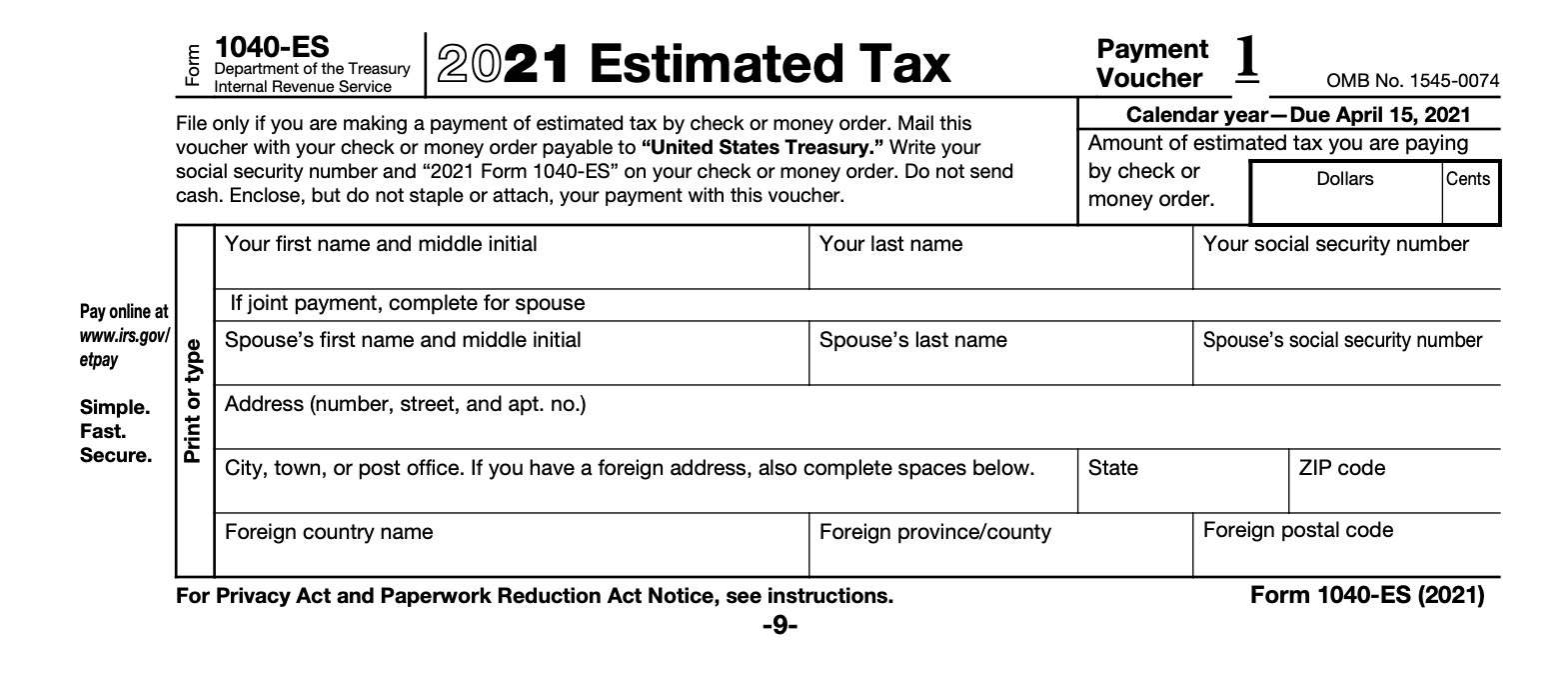

Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Paying your annual tax Online Bank account Web Pay Credit card. Estimated Income Tax Payment Voucher for Fiduciaries.

A standard payment voucher should not be used as a substitute for an estimated payment voucher. See important information for NYC residents with. 2021 PA-40 ES INDIVIDUAL EX 12-20 DECLARATION OF ESTIMATED PERSONAL INCOME TAX DECLARATION OF ESTIMATED PERSONAL INCOME TAX PA-40 ES Use the 2021 Form PA-40.

If you made a combined estimated tax payment for the first and second quarter that was due on or before July 15 2020 and it was more than 20000 you must make. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. A partnership or S corporation mailing a.

Individual Estimated Tax Payment Form.

Budget Planning Concept Accountant Wear Mask Is Calculating Company S Annual Tax Calendar 2021 And Persona In 2022 Tax Deadline Budget Planning Estimated Tax Payments

Form 1040 Income Tax Return Irs Tax Forms Income Tax

Pin On Tax Tips For Business Owners

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

Facebook Payments On Hold How To Release Your Monetization Earnings Help Me Boss Monetize Hold On Earnings

2

Pin On Hhh

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

Estimated Tax Payments Youtube

Fillable Form 2290 2016 Power Of Attorney Form Irs Forms Fillable Forms

Quarterly Tax Dates Remember This Quarterly Taxes Work For Hire Remember

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Happens If You Miss A Quarterly Estimated Tax Payment

What Happens If You Miss A Quarterly Estimated Tax Payment

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Pin On Starting A Business Side Hustles After Divorce

Best Ca Firm In Delhi Income Tax Return Income Tax Income